The 2024 federal budget: Bad news for medical professional corporations

The 2024 federal budget[1] was released on 16 April 2024. It includes major spending on housing, the Canada Disability Benefit, and a national school food program.[2] These initiatives will come at a significant cost: Finance Minister Chrystia Freeland projected a $40 billion deficit this fiscal year. According to the CBC, the government will spend more this year to service the growing $1.4 trillion national debt than on health care.[2]

To help pay for some of its commitments, the government increased the taxable portion (aka the “inclusion rate”) of capital gains from 50% to 66.67%. Changes take effect on 25 June 2024[3] and are expected to bring in about $19.3 billion over the next 5 years.[4]

The government’s plan to tax the “very wealthiest” has been criticized by many for failing to account for how middle-class Canadians and small businesses, including medical professional corporations, will be affected. Immediately following the budget announcement, CMA President Dr Kathleen Ross’s remarks were quoted in a Globe and Mail article titled “Changes to capital-gains tax may prompt doctors to quit, CMA warns.”[5]

So, what is a capital gain? And why do these changes matter to physicians?

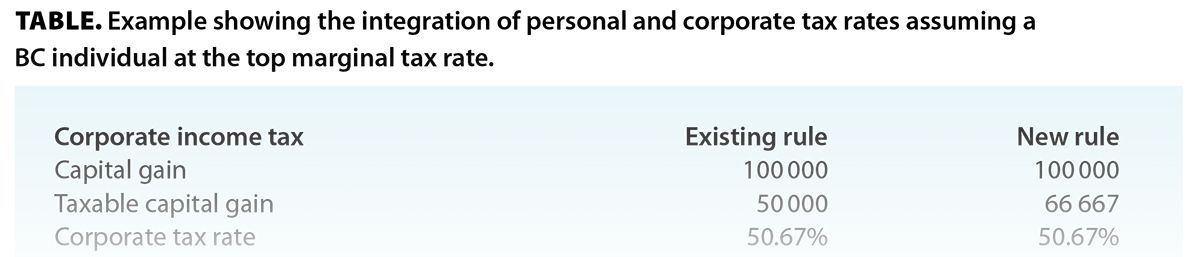

A capital gain is an appreciation in value above what was originally paid to acquire an investment. Capital gains generally apply to the sale of stocks, real estate (except a principal residence), and assets used in a business. For example, if you buy stocks for $100 000 and sell them for $150 000, the capital gain is $50 000. At an inclusion rate of 50%, that means $25 000 would be added to your total income and taxed at your applicable tax rate [Table].[6] Of note, capital gains inclusion rates have varied in recent decades, reaching as high as 75% in the 1990s.[4]

Many Canadians will not be affected by the tax increase, because the new 66.67% inclusion rate applies only to gains over $250 000 for individuals.[7] Individual capital gains below $250 000 that are outside of a sheltered tax account like a TFSA or RRSP will still be taxed at the 50% inclusion rate.

However, the majority[8] of physicians are incorporated, a structure that enables them to earn professional income that is taxed at a lower tax rate than if that income was earned personally. The corporation’s tax-deferred dollars can then be invested as retirement savings, and physicians can pay themselves income in the form of salary or dividends. Unlike individuals, whose capital gains are taxed at 50% for the first $250 000, physicians’ medical corporations receive no such exemption and will have all of their capital gains subject to the 66.67% inclusion rate.[6] In other words, the new higher inclusion rate applies to every dollar of capital gains of a corporation. A physician would realize the effects of these changes upon selling property or cashing in investments or shares held by their corporation.[7]

Until now, the integration of corporate and personal taxes would generally make a taxpayer indifferent to realizing a capital gain personally versus corporately. The changes introduced in the 2024 federal budget have thrown the foundational principle of integration into disarray, now making it significantly disadvantageous to realize capital gains in a corporation before the net proceeds are distributed.

Dr Ross called the changes “one more hit to an already beleaguered and low-morale profession.” On behalf of the CMA, Dr Ross has asked the government to exclude medical professional corporations from the capital gains changes. At the time this editorial was published, no response to this request had been communicated. Alternatively, I wonder if it might be prudent to ask that individuals be allowed to allocate their annual personal capital gains limit of $250 000 to their corporation.

What now? Do we feverishly sell off investments prior to 25 June 2024? Invest outside of the corporation going forward? Or continue as is? I will require the careful analysis of an accountant to determine the best financial strategy. The more difficult problem to address for some, however, might be the psychological sting of once again feeling underappreciated by our government.

—Caitlin Dunne, MD, FRCSC

Acknowledgments

I wish to acknowledge Mr Matthew Baker, CPA, for his invaluable contributions and editing of this piece. Mr Baker is a tax partner at Baker Tilly Canada in Vancouver and can be reached at Matthew.Baker@bakertilly.ca, in case anyone else feels as blindsided as I did after these budget changes.

hidden

|

| This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License. |

References

1. Government of Canada. Federal budget. Last modified 16 April 2024. Accessed 25 April 2024. www.canada.ca/en/department-finance/services/publications/federal-budget.html.

2. Tasker JP. Freeland’s new federal budget hikes taxes on the rich to cover billions in new spending. CBC News. Updated 17 April 2024. Accessed 25 April 2024. www.cbc.ca/news/politics/federal-budget-2024-main-1.7175052.

3. Scotia Wealth Management. 2024 federal budget summary. Accessed 25 April 2024. https://enrichedthinking.scotiawealthmanagement.com/2024/04/17/2024-federal-budget-summary/resource-link/pdf.

4. The Decibel Staff, Raman-Wilms M, Farooqui S. The capital gains tax, explained. The Decibel. 22 April 2024. Accessed 25 April 2024. www.theglobeandmail.com/podcasts/the-decibel/article-the-capital-gains-tax-explained.

5. Hannay C. Changes to capital-gains tax may prompt doctors to quit, CMA warns. The Globe and Mail. Updated 25 April 2024. Accessed 25 April 2024. www.theglobeandmail.com/business/article-capital-gains-tax-canadian-medical-association.

6. Government of Canada. Tax measures: Supplementary information. Last modified 16 April 2024. Accessed 25 April 2024. https://budget.canada.ca/2024/report-rapport/tm-mf-en.html.

7. Farooqui S. Middle-class Canadians could be hit by increases to capital gains tax. Here’s how to prepare. The Globe and Mail. Updated 18 April 2024. Accessed 25 April 2024. www.theglobeandmail.com/investing/personal-finance/household-finances/article-middle-class-canadians-could-be-hit-by-increases-to-capital-gains-tax.

8. Stewart M. Physicians’ offices in Canada: Assessing their economic footprint. The Conference Board of Canada. 2017. Accessed 25 April 2024. www.cma.ca/sites/default/files/pdf/health-advocacy/activity/physicians_%20offices_canada_economic_footprint_2017_e.pdf.